Go Fund You’s investment structure is forged by a strategic repository of Partners defined as Angel Investors, Venture Capitalist, Private Equity and Debt Providers interested in steering the future. Our proprietary Assessment and Funding Algorithm is the backbone of our approach and methodology.

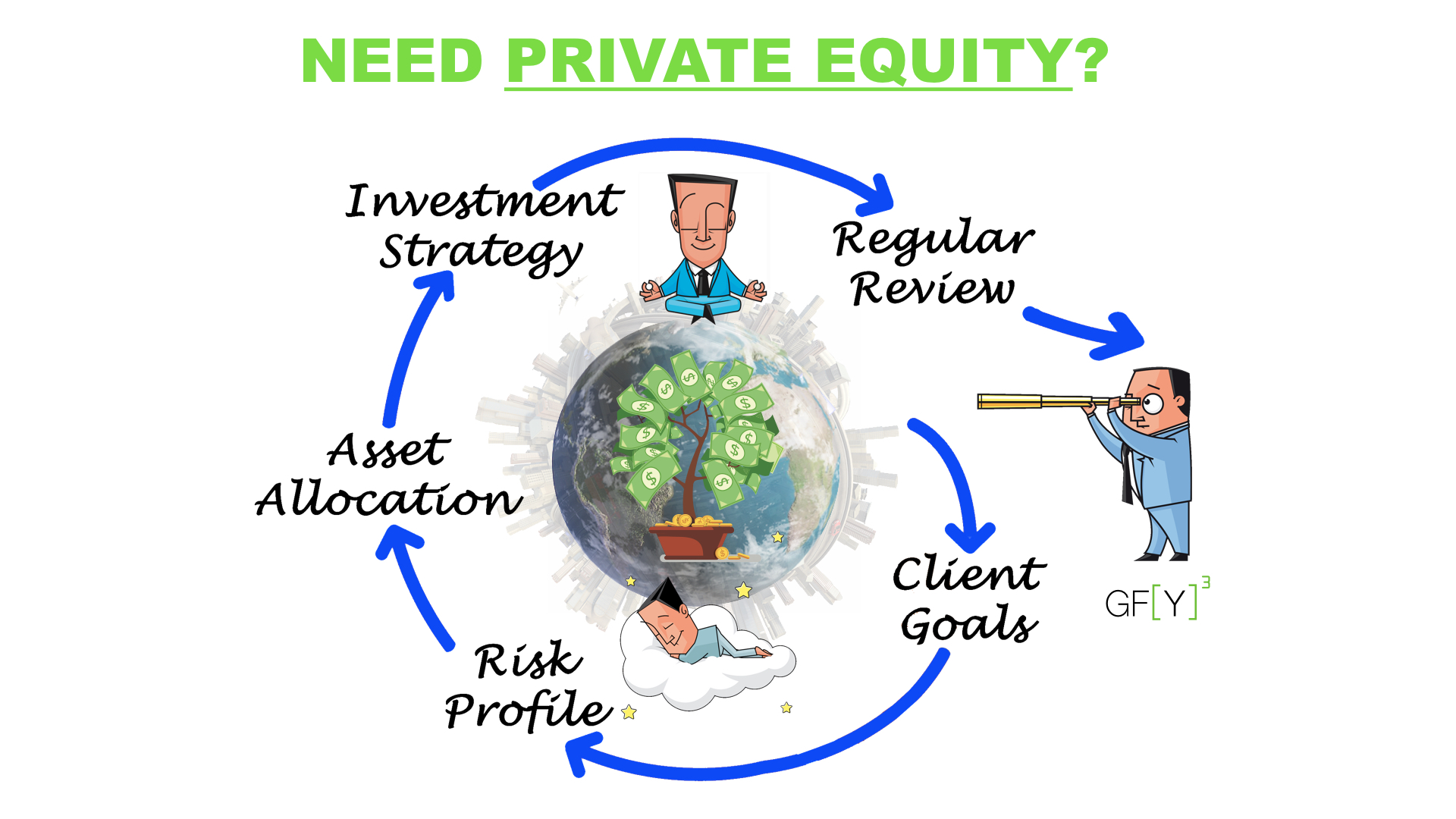

GOFUNDYOU’s private equity programs offer funding vehicles that nurture an existing foundation and its building blocks in order to further leverage and grow an entity’s equitable value and security. These private equity programs secure long term sustainability while reinforcing its economic moat and value proposition.

GOFUNDYOU’s private equity programs require a specific investor criterion and performance metric by way of tangible assets, cash flow, risk factor and internal rate of return.

Our private equity approach seeks to identify and define consumer based corporate valuation (CBCV) with a bottom up approach that focuses on what matters most – creating durable, long-term value through customer acquisition, retention, development and to worry less about surface-level metrics like sales growth in a vacuum.

Key Private Equity Factors & Differentiators

- Early mid stage company with 18% + IRR

- Continued disciplined capital management to build capability to support long term growth.

- A robust and well strategized IP portfolio to protect and grow its products and technology.

- Economic Moat is clear and well defined

- An exit option or strategy carefully devised on the basis of value to allow max monetization

- Board maintains a risk register which is regularly reviewed.

- Operational optimization to control costs while maintaining high standards of customer service.

- That there is no significant exposure to change in carrying value of financial liabilities

- Maintain a balance between continuity of funding and flexibility through the use of overdrafts and bank loans.

- Operates and sustains a holistic business model that demonstrates intrinsic value by way of financial metrics, community integration and market growth.