VENTURE CAPITAL

GOFUNDYOU’s venture capital catapults and scales your business to attainable heights and sustainable success. GOFUNDYOU’s venture capital programs provide the vital provisions and nourishment that a business requires to fully vest within their market space and grow organically to ensure capitalization, market share and monetization.

These venture capital programs align with GOFUNDYOU’s fundamentals and ethical practices built on the believe that economic framework of a business should only be measured on a finite mix of intangible and tangible resources. And not on a predictive narrative of abstract possibilities or fractions that never come into fruition.

Our starting a business programs stem from a repository of Angel Investors, Venture Capital, Private Equity and Debt Providers interested in steering the future. Our proprietary Assessment and Funding Algorithm is the backbone of our approach and methodology.

The Fundamentals:

In order to achieve these goals we have designed a multi-dimensional Assessment tool. This tool is reinforced with a qualification algorithm that carefully assess key business feasibility and sustainability components. The resulting data allows us to baseline and compare GO FUND YOU’s pre and post inoculation funding programs.

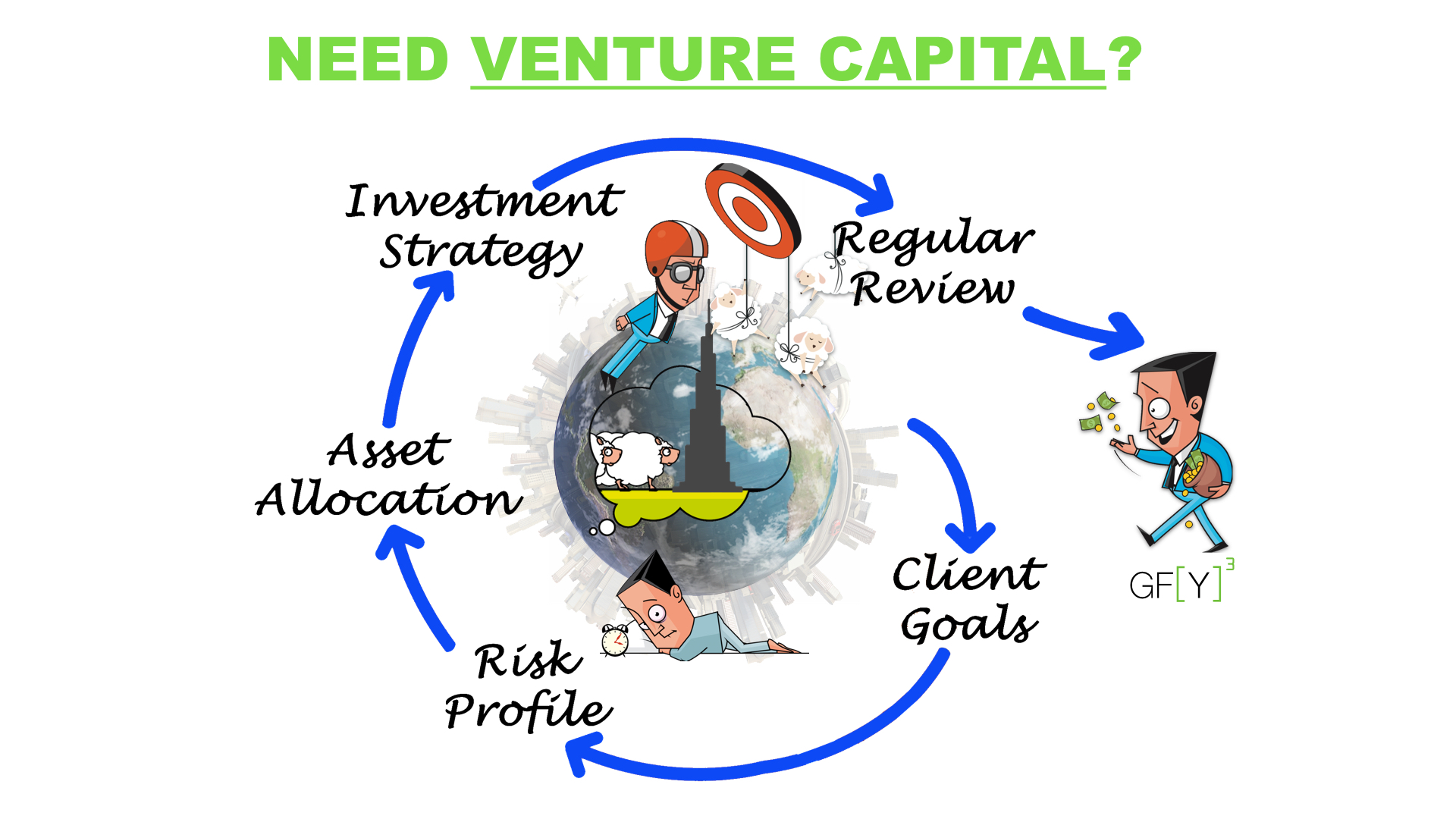

Our Assessment and Algorithm is derived from four dimensions;

I. Risk Mitigation – Planning, measuring and controlling forecasts

II. Operational Coherence – Maximizing output with minimum inputs

III. Longitudinal Sustainability – Maintaining point of equilibrium under present and future conditions

IV. Intrinsic Value – Ensuring qualitative and quantitative attributes converge intrinsically to exceed extrinsic market values

Vital Ingredients Needed To Attract Venture Capital:

Whether Venture Capital, Angel Investment or Debt Financing GO FUND YOU’s investment criterion seeks to identify within your business model the following key questions and ingredients in order to attract money and above all show capital efficiency;

1. What problem does your solution impact or solve?

2. How can we measure the performance of that solution?

3. What is the added value the solution proffers in dollars and cents?

4. What is the current stage of the solution’s ability to deliver maximum and target result?

5. What is the investment amount and specific allocation?